EMI Masterclass: Learn Equated Monthly Installments from Scratch

EMI (Equated Monthly Installment) is the fixed amount a borrower pays every month to repay a loan over a set period. Each EMI consists of a portion of the principal (original loan amount) and a portion of the interest charged by the lender.

What is an EMI?

In the realm of personal and business finance, Equated Monthly Installment (EMI) has become a game-changing concept that simplifies how people manage large expenses. Whether you're purchasing a home, a car, electronic gadgets, or even funding higher education, EMI enables you to spread the cost over a specific period instead of paying the entire amount upfront. This makes high-value purchases more affordable and manageable, especially for individuals who prefer financial flexibility or have limited immediate liquidity.

An EMI is a fixed payment amount made by a borrower to a lender at a scheduled date each calendar month. The EMI typically includes both the interest on the loan and a portion of the principal amount, ensuring that the loan is paid off in full over time. Banks, non-banking financial companies (NBFCs), and digital lenders offer EMI options across various loan products like home loans, personal loans, auto loans, and consumer durable loans.

By converting a lump-sum obligation into smaller, periodic payments, EMI has revolutionized consumer behavior, boosted purchasing power, and promoted financial inclusion. Moreover, with tools like online EMI calculators and pre-approved loan offers, planning and managing EMIs has never been easier. Understanding how EMI works is essential for making informed financial decisions and maintaining long-term financial health.

Components of an EMI

Principal (P)

The amount you borrow

Higher principal = Higher EMI

Interest Rate (r)

The percentage charged by the lender annually

Higher rate = Higher EMI

Tenure (n)

Loan repayment period (months or years)

Longer tenure = Lower EMI

EMI

Monthly payment combining principal and interest

Fixed amount throughout tenure

The EMI Formula

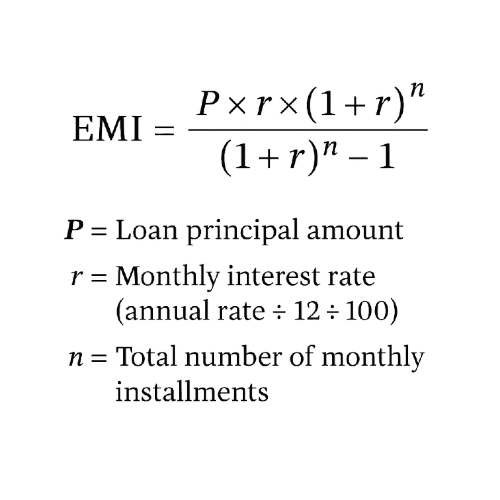

The mathematical foundation of EMI calculation lies in the time value of money principle. The formula accounts for the present value of future payments and the compounding effect of interest. By factoring in both the loan principal and the interest rate over the tenure, EMI ensures consistent payments throughout the repayment period. This standardized structure helps borrowers plan their finances better and avoid surprises in monthly budgeting.

Example: Suppose you take a loan of ₹5,00,000 at an annual interest rate of 10% for a tenure of 5 years (60 months). The monthly interest rate (r) would be 10 ÷ 12 ÷ 100 = 0.00833, and the total number of EMIs (n) would be 60.

Using the formula:

EMI = [P × r × (1 + r)n] ÷ [(1 + r)n - 1]

Plugging in the values:

EMI = [500000 × 0.00833 × (1 + 0.00833)60] ÷ [(1 + 0.00833)60 - 1] ≈ ₹10,624

So, the borrower pays ₹10,624 per month for 60 months.